Risk management

It is recommended to read our risk management guide before opening any trades.

While day trading forex signals can produce large short-term gains, long-term success in currency markets requires a disciplined approach focused on risk management rather than “get-rich-quick” schemes. Prudent risk controls and trade management are essential to achieving consistent profits over numerous transactions.

That is why we have created extensive educational materials on risk management; protecting capital is crucial for traders hoping to participate in forex markets for an extended period. It is important to remember that two traders can take opposite sides of the same trade, with one profiting and the other losing, due entirely to differences in risk profiles and position sizing. For newcomers to the industry, gaining a solid foundation in both trading fundamentals and risk protocols will serve you well as your experience grows.

We encourage all current and potential clients to review our risk management guidelines and quick trading guides. With diligence in these areas, traders stand the best chance of navigating short-term volatility to achieve their long-term financial goals.

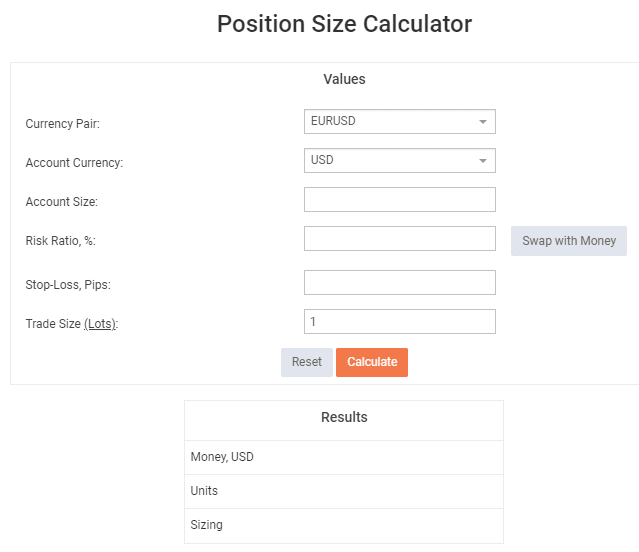

Here are some links and basic calculations that can help you:

This is one of the most important calculators, if not the most important, regarding risk management. Every trader must learn how to position their trades with the right lot sizes based on the account balance. If not positioned correctly, a trader can lose the account balance in minutes.

Here is an example. If you open an account with $500 with 1:500 leverage you can use maximum 2 lot sizes. So, if u want to risk $100 with SL of 100 pips in a pair like EURUSD (most of our daily forex signals in the free telegram group are with this amount of stop loss in pips) you might use around 0,5 lots. Usually we suggest risking around 2-3% of the account balance, which means in this case – $10-15 per trade. This way it is required to use max 0,05 – 0,08 lots.

Also, remember that a trader must always put a stop loss in order to minimize the losses and protect the account balance. It is better losing a small amount of money than blowing the entire balance. Trading daily forex signals is not about winning and being right all the time. It is all about how you tend to manage your trades to be profitable in the long-term. One strategy is to trail your stop loss (SL) to breakeven every time Take profit 1 (TP1) hits.

Another important thing is to be careful if there are important news coming in a specific day as such events impact prices a lot. Our advice is not to trade during such days or if you already have an opened trade, then move the SL to breakeven or close it. Here is a link where you can watch for such important events: Forex Economic Calendar